We always recommend that you get advice from a solicitor or accountant as to how inheritance tax may affect you. But in the meantime, we’ve put some useful information together for you.

Estates normally have to pay any tax due on the property, cash or possessions, before any money is distributed to the heirs. This is known as Inheritance Tax (IHT).

Only a small percentage of estates are large enough to incur IHT but you mustn’t forget to factor this into your plans when you make your will.

Everyone has a tax-free allowance or ‘nil rate band’ on their estate. This means the estate won’t incur IHT if it’s under a certain amount - this is currently £325,000.

Married couples and civil partners are allowed to pass their entire estate to their spouse tax-free when they die. They can also pass on their unused tax-free allowance to their spouse. So if a husband dies and his estate was under £325,000, his wife can take his allowance and add it to her own tax-free allowance so her estate will only incur IHT if it’s worth over £650,000 when she dies.

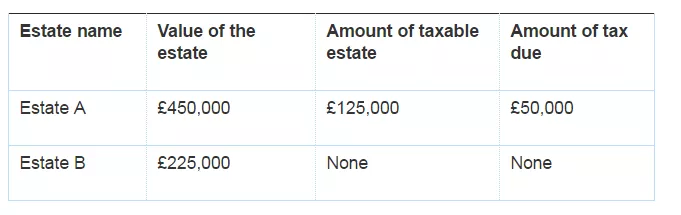

The tax rate is currently 40% of the estate that is above the nil rate band. The table below is a simple example of how the tax is calculated for two different estates.

Since 6 April 2017, each person gets an additional tax-free allowance to use against the value of their home if they leave their home to their children or grandchildren. This is called the ‘residence nil rate band’. The allowance is £175,000. This can also transfer to the surviving spouse, if it isn’t used up already. It could also apply if you’ve downsized or sold your property.

This means a married or civil partnership couple could leave their heirs a combined estate of up to £1 million without incurring IHT.

IHT is normally paid from the funds in the estate, or from money raised from the sale of assets, within six months of the person’s death, otherwise HMRC will start charging interest.

It’s usually the executor who is responsible for working out the value of the estate, how much IHT is due and then paying it. If there isn’t a will, it’s the administrator of the estate who does this. Once the tax and debts are paid, the executor can distribute what remains of the estate to the beneficiaries.

Trying to reduce how much IHT is due on an estate is complicated and we always recommend getting advice form a solicitor, but here are some pointers:

1) Make a gift to your partner

If you’re married or in a civil partnership, you can give anything you own to your spouse or civil partner – so your estate won’t have to pay IHT on what the gift is worth.

There are different and complicated rules if your spouse or civil partner’s permanent home is outside the UK, so make sure you take advice before doing anything.

2) Give to family members or friends

If you give something to a friend or a family member so that you no longer get any benefit from it, the value of the gift will still be included in your estate for IHT – but only for seven years.

You can give away limited amounts every year and not have to pay IHT (known as an annual exemption) – e.g. you can give away up to £3,000 a year to anyone and you can give away money to each child or grandchild when they get married.

Just be aware that there might also be Capital Gains Tax to pay on certain assets that you give away in your lifetime. Check with a solicitor if you're unsure.

If you’re thinking about giving away money or assets to your family and friends to reduce IHT, it’s very important you make a record of:

- Who you gave it to.

- When you gave it.

- What you gave, and.

- How much it’s worth.

This will make it easier for the executor of your estate to work out during probate what parts of your estate are liable for tax.

3) Put things into a trust

A trust is a legal arrangement where you give cash, property or investments to someone else so they can look after them for the benefit of a third person.

If you put anything into a trust (which you, your spouse and none of your children under 18 years can benefit from), then it no longer belongs to you and this means that when you die the value won’t be included when your IHT bill is calculated.

There are several different kinds of trust. Some trusts will have to pay IHT in their own right; others might have to pay Income Tax or Capital Gains Tax. When you set up a trust you need to clearly say:

- When the trust becomes active.

- Who the trustee and beneficiaries are.

- What the assets of the trust are.

The kind of trust you choose depends on what you want it to do. The most common options are:

- Bare trust – the simplest kind where the beneficiary receives everything straight away (as long as they’re over 18).

- Interest in possession trust – the beneficiary can receive income from the trust straight away, but doesn’t have a right to the cash, property or investments that generate that income. The beneficiary will need to pay income tax on the income received.

- Discretionary trust – the trustees have absolute power to decide how the assets in the trust are distributed and make investment decisions on behalf of the trust.

- Mixed trust – combines elements from different kinds of trusts.

- Trust for a vulnerable person – if the only beneficiary of the trust is a vulnerable person there’s usually less tax to pay on income from the trust.

- Non-resident trust – a trust where all the trustees are resident outside the UK. This can sometimes mean the trustees pay no (or a reduced amount of) tax on income from the trust.

The rules around trusts are complicated so you must take advice from an expert.

4) Leave something to charity

Anything you leave to charity is free of IHT so it can be a useful way of reducing your IHT bill, while benefiting a good cause. If you leave at least 10% of your estate to us, for example, it will cut the IHT rate to 36% rather than 40% and is set against the balance of the estate that exceeds the nil-rate band (currently £325,000).

Make sure that you include all the information your executor will need including:

- The name of the charity, (spelled correctly so there are no arguments).

- The registered charity number and registered address.

- The type and value of gift (a pecuniary – a fixed amount, or residuary – a percentage or share of the estate).

- A receipt clause so the charity’s trustee or treasurer can accept the gift.

- A merger clause so if the charity has merged or ceases to exist, your executor can pay the gift to the new charity or a charity with similar charitable values.

More information about leaving a gift towards our work

5) Take out life insurance

If you take out a life insurance policy, it won’t reduce the amount of IHT due on your estate, but the pay-out may make it easier for your surviving family to pay the bill. But if you do this, make sure the life insurance pay-out goes into a trust. If you don’t, it will make your estate bigger and you’ll have to pay more tax, so you should get advice from a solicitor.